Which Best Describes a Credit Default Swap

117 All of the following describe the market for credit default swaps on mortgage-backed securities in the mid-2000s EXCEPT A an increasing number of buyers were speculators. The CDS buyer buys protection by making periodic payments to the seller until the end of the CDS life or a credit event occurs.

Solved 7 Which Best Describes A Credit Default Swap A It Chegg Com

166 Credit derivatives BLM.

. D It represents a way for the issuer to establish its. That is the seller of the CDS insures the buyer against some reference asset defaulting. C Issuers are taking out insurance in case of default.

It has a higher rate to compensate for the possibility of one party defaulting c. Credit default swap is used to transfer the credit risk exposure which arises from the fixed income securities such as bond. Which best describes a credit default swap.

A shortcoming of swaps that has led to the domination of the swaps market by large firms and financial institutions is theneed to assess creditworthiness. C The issuer receives payments from the buyer in return for agreeing to make payments to the buyer if the security goes into default. In an option contract.

Asked Aug 17 2017 in Business by SingleMind. A credit default swap is when the issuer of a bond ends up taking insurance. All of the following describe the market for credit default swaps.

When credit risk increases swap premiums increase but when interest rate risk increases swap premiums decrease. These contracts are linked to either a specific reference entity. The swap runs for 5 years and is based upon a term loan to LMN Corp.

When credit and interest rate risk increases swap premiums increasec. It carries a higher credit rating than most other swaps d. Business Finance QA Library Which of the following most accurately describes the behavior of credit default swapsa.

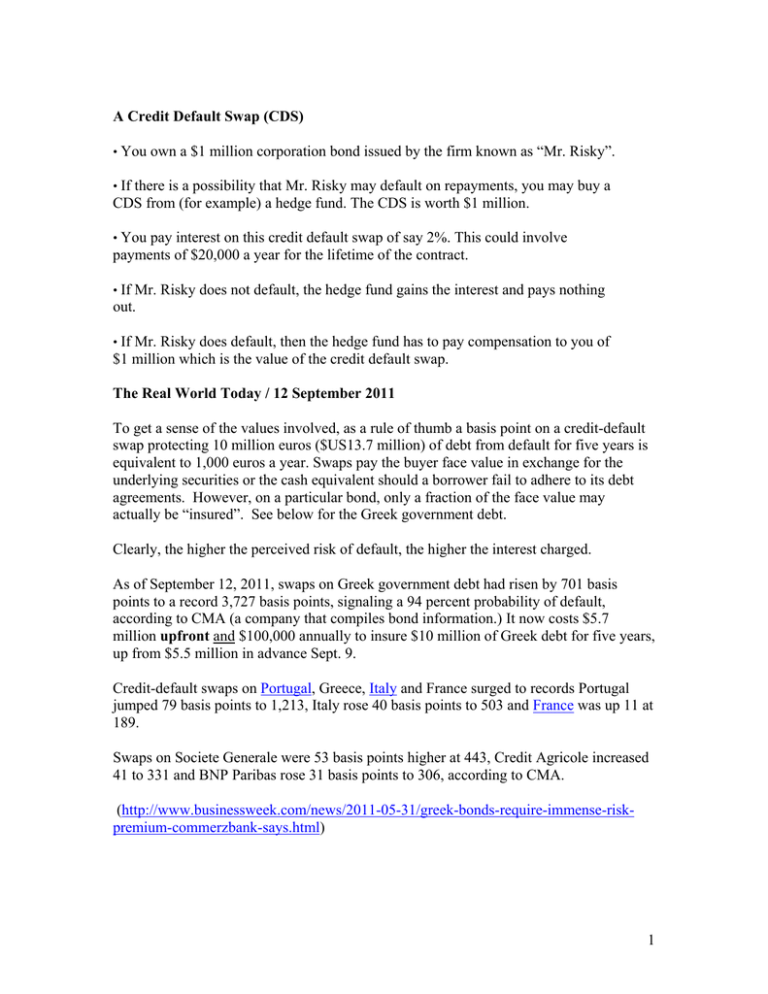

The ABC Bank enters into a credit default swap with XYZ Financial. The issuer receives payments from the buyer in return for agreeing to make payments to the buyer if the security goes into default. A It is designed to reduce interest-rate risk.

When credit risk increases swap premiums increaseb. The Credit Default Swap Index CDX is a benchmark index that tracks a basket of US. They allow purchasers to buy protection against an unlikely but devastating event.

Which of the following best describes a credit default swap. Which of the following statements best describes a feature of an option contract. D Issuers are taking out insurance in case of default.

Explain the difference between a credit swap and. B The issuer receives payments from the buyer in return for agreeing to make payments to the buyer if the underlying security goes into default. It off if another party external to.

A limitation of interest rate swaps is that there is a risk to each swap participant that the counterparty could default on its payments. Which best describes a credit default swap. See full answer below.

Which best describes a credit default swap. A Credit default swap is a financial swap agreement that the seller of the Credit default swap will compensate the buyer in the event of a default. It exchanges the realized return on an asset including both income and capital gainslosses for a return equal to LIBOR plus a spread on the initial value of the asset.

When credit and interest rate risk increase swap premiums increasec. In very general terms the buyer of a CDS makes periodic payments in exchange for a positive payoff when a credit event is deemed to have occurred1. Credit default swaps act like insurance policies in.

When credit risk increases swap premiums increaseb. The intrinsic value of your option is25. A credit default swap CDS is a financial derivative that guarantees against bond risk.

And emerging market single-issuer credit default swaps. B The issuer receives payments from the buyer in return for agreeing to make payments to the buyer if the security goes into default. Which of the following most accurately describes the behavior of credit default swapsa.

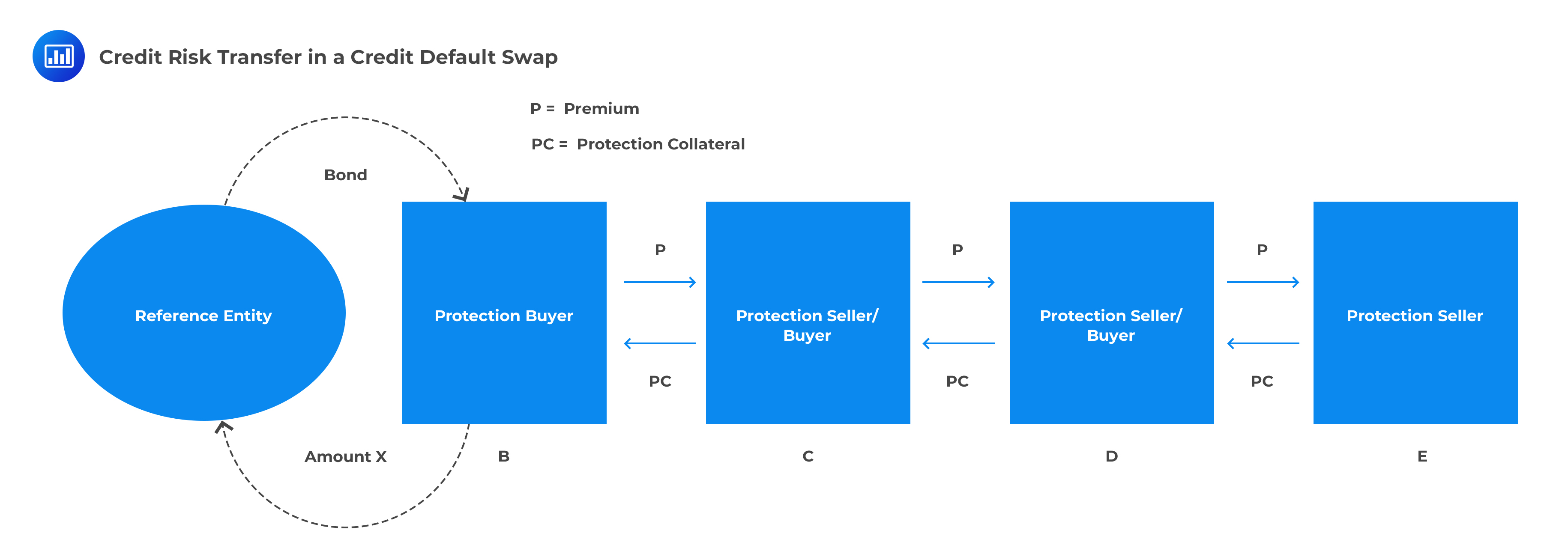

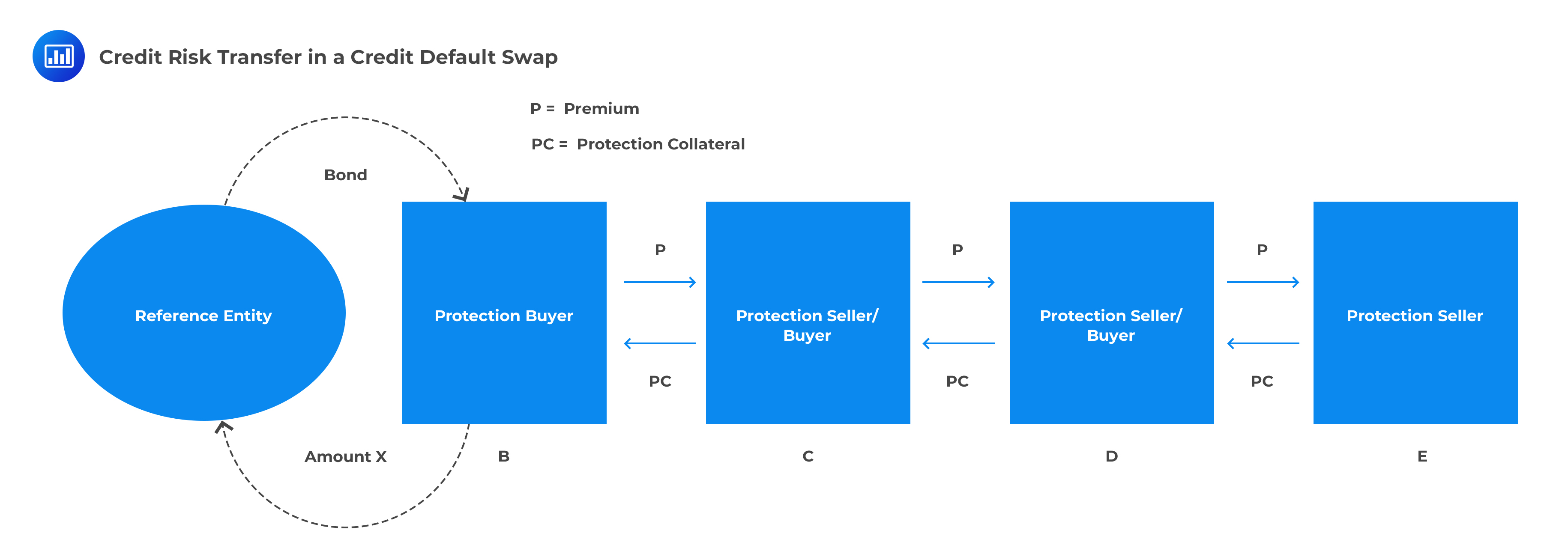

Credit default swap A derivative contract between two parties a credit protection buyer and a credit protection seller in which the buyer makes a series of cash payments to the seller and receives a promise of compensation for credit losses resulting from the default - that is a pre-defined credit event - of a third party. C Issuers are taking out insurance in case of default. Buying protection has a similar credit risk position to.

C Issuers are taking out insurance in case of default is the best answer. It can be thought of as insurance against credit risk. Unfortunately LMN goes bankrupt a year after this swap agreement becomes.

Which of the following best describes a total return swap. The sale of a credit default swapc. Swaps work like insurance policies.

The CDS purchaser pay annual premium to the seller of the swap and in return collect the payment in case of default and it work as an insurance against the non-payment of the fixed liability. Credit Default Swaps CDS are a bilateral OTC contracts that transfer a credit exposure on a specific reference entity across market participants. Which of the following would be the liquid method of exploiting thisa.

It allows one lender to swap its risk with another. When credit risk increases swap premiums increase but when interest. The short sale of the bond.

D It represents a way for the issuer to establish its creditworthiness. An investor believes that a bond may temporarily increase in credit risk. It exchanges the promised return on an asset including both income and.

As of June of 2016Facebook FBhad no debtSuppose the firms managers consider issuing zero-coupon debt with a face value of 231 billion due in January of 2019 19 monthsand using the proceeds to pay a special dividendFB has 231 billion shares outstandingwith a market price June2016of 11662The risk-free rate over this horizon is 025. Asked Aug 17 2017 in Business by VonDutch. The purchase of a credit default swapb.

Investments 9th Edition Edit edition Solutions for Chapter 14 Problem 27P. It is protected against default b. A It is designed to reduce interest-rate risk.

Credit Default Swaps CDS A credit default swap is an agreement between the buyer and seller to exchange the borrowers credit risk. Suppose that Acme Widget is currently selling for 100 per share and you own a call option to buy Acme Widget at 75 per share. The size of the protection payment is 5 per year.

Which of the following best describes a credit default swap.

Credit Risk Transfer Mechanisms Frm Analystprep

/78293570-5bfc2b8cc9e77c0026b4f8e9.jpg)

Comments

Post a Comment